surgut-navigator.ru

Learn

Best Stocks Under $20 A Share

As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. What Makes a Good Swing Trade Stock? Swing trading involves capturing short- to medium-term price movements in stocks or other financial. 4 Good Tech Stocks Under $20 ; Advanced Micro Devices · AMD · $ ; CalAmp · CAMP · $ ; HP · HPQ · $ ; Vishay Intertechnology · VSH · $ Cheap Stocks Below 20 Rs · 1. Jagjanani Text. , , , , , , · 2. Ventura Textiles, , , , , Stocks below Rs 20 · 1. Jagjanani Text. , , , , , , · 2. Ventura Textiles, , , , , , 1 rule of investing: keep your losses under control. Check Out IBD Live! Trade Top Stocks With Growth Investing Experts And Pros. Stock No. 1: Logistics Play. What Makes a Good Swing Trade Stock? Swing trading involves capturing short- to medium-term price movements in stocks or other financial. Best stocks under $20 · Infosys (INFY). · Blue Owl Capital Inc. (OWL). · Permian Resources Corp. (PR). · Vipshop Holdings Ltd. (VIPS). · iQIYI Inc. (IQ). As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. What Makes a Good Swing Trade Stock? Swing trading involves capturing short- to medium-term price movements in stocks or other financial. 4 Good Tech Stocks Under $20 ; Advanced Micro Devices · AMD · $ ; CalAmp · CAMP · $ ; HP · HPQ · $ ; Vishay Intertechnology · VSH · $ Cheap Stocks Below 20 Rs · 1. Jagjanani Text. , , , , , , · 2. Ventura Textiles, , , , , Stocks below Rs 20 · 1. Jagjanani Text. , , , , , , · 2. Ventura Textiles, , , , , , 1 rule of investing: keep your losses under control. Check Out IBD Live! Trade Top Stocks With Growth Investing Experts And Pros. Stock No. 1: Logistics Play. What Makes a Good Swing Trade Stock? Swing trading involves capturing short- to medium-term price movements in stocks or other financial. Best stocks under $20 · Infosys (INFY). · Blue Owl Capital Inc. (OWL). · Permian Resources Corp. (PR). · Vipshop Holdings Ltd. (VIPS). · iQIYI Inc. (IQ). As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less.

When factoring in the stocks low beta and high dividend, it seems like a great hold during a bear market. Best Stocks to Buy · USA Stock Forecasts · BSE (Bombay) Stock Forecasts · TSX Share, Preferred Stock, Quantafuel ASA, Right (blank) – Not Available, i.e. Best Penny Stocks Under $ Right Now · #1 - Lucid Diagnostics · #2 - Unicycive Therapeutics · #3 - Dragonfly Energy · #4 - Cue Biopharma · #5 - Wag! Group · #6 -. The 7 Best Stocks Under $20 to Buy Now. in Press Releases by— Feed Wire. Share. News and Media. The content of this article is restricted. Please login to. Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). As we'll see below, 3M had raised its payout for 64 consecutive years. The dividend cut means this Dow Jones stock is on the Aristocrats chopping block when. Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). Stocks Under $10 · SmartKem Inc SMTK. Price: $ Daily change: N/A · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · Baiyu Holdings Inc BYU. Best Dividend Stocks Under $20 is a list of top stocks today that are trading below $20 per share. The dividend penny stocks under 20 list is updated each. List of Penny Shares Below 20 Rs ; DPSC. D · DPSC. B S · , % ; Steel Exchange India. S · Steel Exchange India. B S · , % ; Hotel Leela Venture. H. 1. MAG Silver Stock. MAG Silver Corp (MAG) is a mining entity with a sharp focus on silver, primarily engaged in the exploration and. Some stocks under $25 are not the greatest stocks. But I award him share than spend $20 on a stock that will go down in value. 1. Choose a stock screener · 2. Set a target for future earnings growth rate · 3. Use the P/E ratio to find potentially undervalued stocks · 4. Focus on market cap. 9 Best Cheap Stocks to Buy Under $20 ; Cheap Stock, Price-to-Book Ratio* ; Blue Owl Capital Inc. (OWL), ; First Advantage Corp. (FA), ; Gap Inc. (GPS), 3. Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). Some stocks under $25 are not the greatest stocks. But I award him share than spend $20 on a stock that will go down in value. Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change: N/A · SmartKem Inc SMTK. Price: $ Daily change: N/A · Outlook Therapeutics Inc OTLK. Best Stocks Under $20 Right Now · #1 - NexGen Energy · #2 - GeoVax Labs · #3 - enCore Energy · #4 - Bioceres Crop Solutions · #5 - ARS Pharmaceuticals · #6 - Hudbay. As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less.

Can You Take Out More Than One Personal Loan

Yes, you can get two personal loans at the same time. There's no rule that limits the number of personal loans you can have at one time, so you can have two or. When you take out a personal loan, the amount you borrow will need to be repaid on a fixed schedule. To borrow more, you have to apply for another loan. The simple answer is yes – it is possible to have multiple loans at the same time. However, there are certain problems that may arise if you wish to do this. Type of disbursement: A personal line of credit is reusable. Once you are approved for it, you can access any portion of the credit line at any time. Interest. Pay off existing debt: Juggling multiple debt payments can be overwhelming and costly due to varying interest rates. By using Magical Credit personal loan, you. In theory at least, if you meet a lender's criteria, and your income is sufficient to cover the repayments on multiple personal loans, there is no legal limit. You can take as many as they give you. The key is that the bank need to verify that the assets will cover their loan security requirements plus. The answer is yes and no. Yes, because interest rates on personal loans are much lower than other types of loans, and they will help you settle your bills. Can I take out more than one loan? Even if you have existing loans, you can still apply for another one. In fact, there. Yes, you can get two personal loans at the same time. There's no rule that limits the number of personal loans you can have at one time, so you can have two or. When you take out a personal loan, the amount you borrow will need to be repaid on a fixed schedule. To borrow more, you have to apply for another loan. The simple answer is yes – it is possible to have multiple loans at the same time. However, there are certain problems that may arise if you wish to do this. Type of disbursement: A personal line of credit is reusable. Once you are approved for it, you can access any portion of the credit line at any time. Interest. Pay off existing debt: Juggling multiple debt payments can be overwhelming and costly due to varying interest rates. By using Magical Credit personal loan, you. In theory at least, if you meet a lender's criteria, and your income is sufficient to cover the repayments on multiple personal loans, there is no legal limit. You can take as many as they give you. The key is that the bank need to verify that the assets will cover their loan security requirements plus. The answer is yes and no. Yes, because interest rates on personal loans are much lower than other types of loans, and they will help you settle your bills. Can I take out more than one loan? Even if you have existing loans, you can still apply for another one. In fact, there.

Your income must be more than the payments you have to make on your debt. This is one of the key ways in which lenders stop people from becoming over-indebted. Having said that, it can be difficult to obtain multiple personal loans, as you'll need to demonstrate your ability to make the payments on all of your personal. Taking out a personal loan can also be a way to consolidate debt. This is the idea of putting all your debts together. If you have several different debts and. One could look into personal loans when they're considering home improvements, cars, consolidating debt that carries higher interest rates, and other events. In fact, you can take two loans from the same bank for personal reasons. If you have a good credit score of or above, and have the repayment. Interest rates on personal loans are usually fixed, which means the interest rate and payment stay the same for the entire loan term. You can also take comfort. loans can't be more than $ Once a loan is funded, you have a limited time frame to cancel your. You can even use it to pay off multiple credit card debts – this way, you can essentially “consolidate” your credit card debts into one personal loan that you'. The answer is 'it depends'. You can certainly take out more than one personal loan, but the determining factor depends on the unsecured credit borrowing limit. Having said that, it can be difficult to obtain multiple personal loans, as you'll need to demonstrate your ability to make the payments on all of your personal. The simple answer is yes. An individual can take more than one Personal Loan. But just like the first loan, you will have to meet the eligibility requirements. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. If you're looking to consolidate debt, your lender may use the loan to pay off your outstanding bills directly, and then deposit any remaining loan amount in. A debt consolidation loan allows you to combine different debts into one loan. So instead of making multiple payments, you're now just making one. Does this. Can I have multiple personal loans at once? Simply put, yes. However, it's a more complicated question, as each lender has different rules. There are also. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Yes, you can take more than one personal loan, as there are no restrictions. But, you would need to meet the eligibility criteria like income, job stability. Yes, you can apply for a second loan through your Plenti account provided you meet certain eligibility criteria. Go over your income: If you and your co-borrower have good incomes, a lender will likely look at your application more favorably than if one of you has.

Important Of Cash Flow

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cashflow is crucial in financial analysis as it provides insights into a business's health, stability, and liquidity. It helps evaluate the company's ability to. Cash flow management is essentially how you manage your operations in a way that's conducive to healthy cash flow. There are a couple of reasons why cash flows are a better indicator of a company's financial health. Cash is King. Profit figures are easier to manipulate. The management of cash and cash flow is important as it can prevent a business from failing. Cash flow is the way that money moves in and out of a business and. Positive cash flow allows for reinvestment, expansion, and financial stability, while negative or insufficient cash flow may require adjustments to spending. Cash flow is a very good measure of a company's financial health. Cash flow also helps you make decisions as to when to expand or purchase additional equipment. 1. Make Better Plans and Decisions. With an accurate cash flow statement, you'll know the exact amount of funds you have available at any given moment. This is. Positive cash flow is what makes your business flourish, and the pace of cash flow is just as important as having cash flow at all. When you have enough money. Efficient cash flow management allows a business to optimize its working capital. By minimizing the time between receiving revenue and paying expenses, a. Cashflow is crucial in financial analysis as it provides insights into a business's health, stability, and liquidity. It helps evaluate the company's ability to. Cash flow management is essentially how you manage your operations in a way that's conducive to healthy cash flow. There are a couple of reasons why cash flows are a better indicator of a company's financial health. Cash is King. Profit figures are easier to manipulate. The management of cash and cash flow is important as it can prevent a business from failing. Cash flow is the way that money moves in and out of a business and. Positive cash flow allows for reinvestment, expansion, and financial stability, while negative or insufficient cash flow may require adjustments to spending. Cash flow is a very good measure of a company's financial health. Cash flow also helps you make decisions as to when to expand or purchase additional equipment. 1. Make Better Plans and Decisions. With an accurate cash flow statement, you'll know the exact amount of funds you have available at any given moment. This is. Positive cash flow is what makes your business flourish, and the pace of cash flow is just as important as having cash flow at all. When you have enough money. Efficient cash flow management allows a business to optimize its working capital. By minimizing the time between receiving revenue and paying expenses, a.

Cash flow refers to the timing of when you receive payments and when you must pay monies owed. A cash flow management system ensures that you don't get. Cash flow indicates the health of a business and whether it will be a good investment. Cash flow comes from various sources, including sales, services. The cash flows from operations are generally considered the most important because they deal with cash that it is generated by businesses primary activities. A cash flow projection is a prediction of what you to expect to happen, with regards to your cash flow, in the coming months. Cash flow is the net cash and cash equivalents transferred in and out of a company. Cash received represents inflows, while money spent represents outflows. A cash flow basically shows if you have enough cash in the bank account to cover expenses. Sounds simple, but you'd be surprised at how many people ignore this. Cash flow from operations determines whether or not a company has enough money to pay its bills. It also indicates whether or not a business can go on operating. Cash flow management monitors cash inflows and outflows to help organizations accurately predict how much money will be available to use in the future. This. In looking at the manufacturing company during a recession, for example, the cash balance was greater at the end of the recession than at its beginning because. Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. Cash flow management means tracking the money coming into your business and monitoring it against outgoings such as bills, salaries and property costs. When. Cash flow statements are one of the key documents investors look at when deciding to finance your business or not. Put alongside the profit and loss (income). Cash flow management is delaying cash outflow for a reasonable length of time and ensuring your customers pay on time. It is the cornerstone of financial health for any business. It encompasses the process of monitoring, analyzing, and optimizing the movement of cash in and out. An effective cash flow management plan can do more than help businesses avoid bankruptcy. It can ensure that bills are paid, promote positive relationships with. 2. Cash Flow Helps With Business Growth. A steady, positive cash flow that is invested to expand your business is a far superior strategy than simply hanging on. Cash flow analysis and statements are essential instruments in financial decision-making. They provide an understanding of the financial health of an. A cash flow statement is one of the most important financial statements for a project or business. The statement can be as simple as a one page analysis or. A cash flow statement is an important financial tool showcasing the amount of cash and cash equivalents available to a business. Importance of cash flow A business needs good cash flow to pay bills and keep trading. Having spare cash also gives a business the opportunity to pursue new.

Two 120v To 240v Converter

.jpg)

Output voltage is VV and VV that can be used at the same time. There are two universal outlets on the device. The voltage converters are made of. The USA V seem to have a fixed cord and a ground switch. I could add this switch or just omit if not needed. surgut-navigator.ru I have a Butcher power transformer #. LVYUAN Voltage Transformer Converter Watt Step Up/Down Convert from Volt to Volt and from Volt to Volt with US Outlet. The current through both V wires of the split phase supply will be 30A. Ground relay for use with Multi or Quattro Inverter/Chargers included. When operating. Supports upright tower installation with USTAND. Features. Step-down/isolation transformer converts high voltage A MWBC is two volt circuits that share a common neutral. However, a Would a voltage converter work? Or do I · img. eddie22Island. owner at self. One two-winding transformer with two secondaries can be give V output if the two secondaries are connected in series with correct dot. voltage into /Vac split phase 2 step down Vac to Vac 3 step up V to Vac. It has two groups of power sources, A and B. Either can be used as. This makes the wire easier to identify and easier for our v to v converting job. Install the Double-Pole Circuit Breaker Hook the two tabs on the back of. Output voltage is VV and VV that can be used at the same time. There are two universal outlets on the device. The voltage converters are made of. The USA V seem to have a fixed cord and a ground switch. I could add this switch or just omit if not needed. surgut-navigator.ru I have a Butcher power transformer #. LVYUAN Voltage Transformer Converter Watt Step Up/Down Convert from Volt to Volt and from Volt to Volt with US Outlet. The current through both V wires of the split phase supply will be 30A. Ground relay for use with Multi or Quattro Inverter/Chargers included. When operating. Supports upright tower installation with USTAND. Features. Step-down/isolation transformer converts high voltage A MWBC is two volt circuits that share a common neutral. However, a Would a voltage converter work? Or do I · img. eddie22Island. owner at self. One two-winding transformer with two secondaries can be give V output if the two secondaries are connected in series with correct dot. voltage into /Vac split phase 2 step down Vac to Vac 3 step up V to Vac. It has two groups of power sources, A and B. Either can be used as. This makes the wire easier to identify and easier for our v to v converting job. Install the Double-Pole Circuit Breaker Hook the two tabs on the back of.

4 prong V plug converter for two V outlets. · P plug, with QVNU2 supplementary protection. · Intended for use with electric V 15 A UltraFast Combo. Voltage Converter, Power Converter from W Power Output V/V Split Phase Inverters-Two Phase Voltage Converter - Zhejiang Bangzhao Electric Co., Ltd. This will energize coil 3 which will in turn close both K3 contacts which will illuminate LMP3 and supply v to JP3. Any interruption of either v circuit. Yes, you could replace the two-pole amp breaker with two single-pole breakers and supply two circuits as you intend, but only if you have a four-wire cable. Yes, you use 2 V circuits to make a V circuit. Get an electrician. Transformer Specifications: 60 Hz Frequency; °C Temperature Rise; Primary Adjustment Taps 2 above, 4 below in FUSE PROTECTED POWER TRANSFORMER - Dual Fuse Protection (V & V). Two VCW – Watt Step Up/Step Down v/v Voltage Converter $ $ The two blocks are the relays that connect power to car. I was surprised to see a current transformer on the line exiting the relay going to the car. Apparently. Residential power in the US is usually provided by the center tapped secondary of a distribution transformer. Two wires are hot, V at degrees out of. You must also make sure that the 2-pole breaker is installed in a position in the panel that picks up both legs of the /V buss bars. Most breaker panels. Conair Dual Mode Travel Plug Adapter & Voltage Converter, V/V to V/V. # Shop for G.E. Major Appliances V Plug Converter (Makes two v outlets) from NFM. Get great deals now on Appliance Accessories at NFM with our low price. A: This adapter is used to connect two GE Profile UltraFast Combo units (model PFQ97HSPVDS). It converts a 4-prong V plug into two V outlets. V 1 Phase Energy Efficient Distribution Transformer from Larson Electronics is powerful, reliable and designed with the environment in mind. (like this) Could I use this to convert my house V to V for the leaf to get level 2 charging? two v outlets on different circuits to obtain v for. Step 1: You Will Need · Step 2: Position the Transformers · Step 3: Position the Other Stuff · Step 4: Wire Up the Transformers · Step 5: VV Outlet Adapter. A dual voltage device can accept both V and V. Luckily, many travel gadgets are dual voltage, so you'll only need a plug adapter, also called a. v to v voltage converters, international plug adapters, voltage testing equipment, residential Tesla chargers. However the response may be different depending on which inverter was connected to external AC. Hooking both inverters to the V Single Phase source (L1 and.

Dallas Texas Mortgage Rate

We've compiled mortgage rate and origination data from Texas to give you an idea of where other borrowers are at. This data is based fixed rate. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. Today's mortgage rates in Dallas, TX are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. The current average year fixed refinance rate rose to %. Texas's rate of % is 13 basis points higher than the national average of %. Today's rate. We are proud to provide the residents of the greater Dallas area with some of the best rates on home mortgage loans, as well as a variety of loan types. Texas year fixed mortgage rates go up to %. The current average year fixed mortgage rate in Texas increased 7 basis points from % to %. View current Texas mortgage rates from multiple lenders at surgut-navigator.ru®. Compare the latest rates, loans, payments and fees for ARM and fixed-rate. Compare Texas mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. We've compiled mortgage rate and origination data from Texas to give you an idea of where other borrowers are at. This data is based fixed rate. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. Today's mortgage rates in Dallas, TX are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. The current average year fixed refinance rate rose to %. Texas's rate of % is 13 basis points higher than the national average of %. Today's rate. We are proud to provide the residents of the greater Dallas area with some of the best rates on home mortgage loans, as well as a variety of loan types. Texas year fixed mortgage rates go up to %. The current average year fixed mortgage rate in Texas increased 7 basis points from % to %. View current Texas mortgage rates from multiple lenders at surgut-navigator.ru®. Compare the latest rates, loans, payments and fees for ARM and fixed-rate. Compare Texas mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans.

Overview of Texas Housing Market ; 15 yr fixed mtg refi, %, %, ; 7/1 ARM refi, %, %, The mortgage rates in Texas are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 28 From professional sports franchises like the Dallas Cowboys, Dallas Mavericks, and Texas A fixed-rate mortgage is the most common type of mortgage loan. 08/22/ in dallas-fort-worth, texas Multifamily/Apartment loan rates start from % for a 10 year fixed with 30 year amortization. Current rates in Dallas, Texas are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. In Texas, that limit is pegged at $, If you take out a home loan that exceeds that, it will be considered a jumbo mortgage. Today's Texas Mortgage Rates. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Today's rate Today's mortgage rates in Texas are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). A fixed-rate mortgage provides the borrower peace of mind knowing their monthly payment will be the same for the life of the loan. We offer 10, 15 and A typical year conforming $, loan with a fixed rate of % (% APR) would have monthly principal and interest payments of $2, A. Find and compare Texas' current home loan and refinance rates from banks and mortgage lenders. TX's average year fixed mortgage rate at %. Compare today's mortgage rates for Dallas, TX. The mortgage rates in Texas are % for a year fixed mortgage and % for a year fixed mortgage. Compare current Dallas, TX mortgage rates. Find the lowest Dallas mortgage rates by reviewing personalized loan terms for multiple programs. Compare Dallas, TX mortgage rates * Points are equal to 1% of the loan amount and lower the interest rate. * Points are equal to 1% of the loan amount and. lender's interest rate and/or lender fees. You are "guaranteed" the The North Texas area, including Dallas, has been hit hard by high mortgage rates. Mortgage rates have been fluctuating over the last month. Freddie Mac reports that the average year fixed interest rate increased again on July 14 to %. Compare Dallas, TX mortgage rates * Points are equal to 1% of the loan amount and lower the interest rate. * Points are equal to 1% of the loan amount and. Home Mortgage Rates in Texas. San Fernando Cathedral in San Antonio Residential Strategies, a housing analyst in Dallas, calculates that median. Today's Mortgage Rates for. · % · % · % · %. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1,

Best Money Lending Website

App for peer to peer lending and borrowing between family and friends. We help you legalize and manage a loan transaction. Our platform also helps you. LendingPoint offers personal loans that fit your budget. We understand that everyone's financial situation is different, so we work with you to find a. Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range. LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. Summary of Top Lenders · SoFi · LightStream · Best Egg · First Tech Federal Credit Union · Avant. Prosper is the FIRST peer-to-peer personal loan lending platform in the US. This means that a personal loan through Prosper comes from traditional investors. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Check your personalized rates · Filter results · LightStream: Bankrate Awards Winner For Excellent Credit · Upstart: Best loan for little credit history. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. App for peer to peer lending and borrowing between family and friends. We help you legalize and manage a loan transaction. Our platform also helps you. LendingPoint offers personal loans that fit your budget. We understand that everyone's financial situation is different, so we work with you to find a. Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range. LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. Summary of Top Lenders · SoFi · LightStream · Best Egg · First Tech Federal Credit Union · Avant. Prosper is the FIRST peer-to-peer personal loan lending platform in the US. This means that a personal loan through Prosper comes from traditional investors. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Check your personalized rates · Filter results · LightStream: Bankrate Awards Winner For Excellent Credit · Upstart: Best loan for little credit history. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here.

Since interest rates and loan terms on a personal loan are fixed, you can select a loan and payment amount that fits within your budget—which is great when you'. SoLo is a community finance platform where our members step up for one another Lending your money to make more money is easier than ever. How to lend on. Need cash fast? Get the cash you need with our quick online installment loans. Fast, convenient, confidential, and secure. No hidden fees. Term Loans up to $K and Lines of Credit up to $K. Get funds as soon as the same day. Best overall: LightStream Personal Loans · Best for debt consolidation: Happy Money · Best for larger loan amounts: SoFi Personal Loans · Best for quick funding. A lock (Locked padlock) or https:// means you've safely connected to surgut-navigator.ru website. Get matched to an SBA-approved lender and find the best loans to. Prosper is the FIRST peer-to-peer personal loan lending platform in the US. This means that a personal loan through Prosper comes from traditional investors. How much do you need? If you are looking for small loans (less than $), you can Google “loan apps” to see what some of those options are. For. Fintech Lending Companies to Know · Prosper Marketplace · Affirm · Scratch Financial · Lendtable · Point · Reach Financial · Nav · Funding Circle. PNC Bank is a great option for those looking for a short term and low-amount loan. Loan terms start at just 6 months with the minimum loan amount starting at. Best for Large Amounts: SoFi SoFi logo. With a $, limit, SoFi personal loans are best suited for those who need to borrow more than what most other. Best P2P lending · Prosper: Best for co-borrowers. · Avant: Best for poor credit. · Happy Money: Best for credit card consolidation. · Upstart: Best for thin credit. Compare personal loan rates from top lenders for September · LightStream Personal Loans · Upstart Personal Loans · Discover Personal Loans · LendingClub. Best Online Mortgage Lenders: Best for overall affordability: AmeriSave US News Rating. Loan Types Offered: Conventional, FHA, VA. Credible is the best way to save money on personal loans, student loans, and your mortgage. Compare top lenders and find low rates in just minutes. LendingTree is a marketplace, built to save you money—we don't make loans, we find them. In fact, we've been finding the best loans for Americans for more than. How does BestMoney Personal Loan matching work? You tell us what you need, then we crunch the numbers to match you with offers from multiple lenders - so. website terms, privacy, and security policies don't apply to outside sites best experience on our site. We never sell your information to third. Get low-interest personal loans quickly with Best Egg. Apply online in minutes & receive funds fast. Start your journey to financial stability now! Home improvement loans and auto financing are also available at P2P lending sites. The interest rates for applicants with good credit are often lower than.

Home Loan Payment Schedule

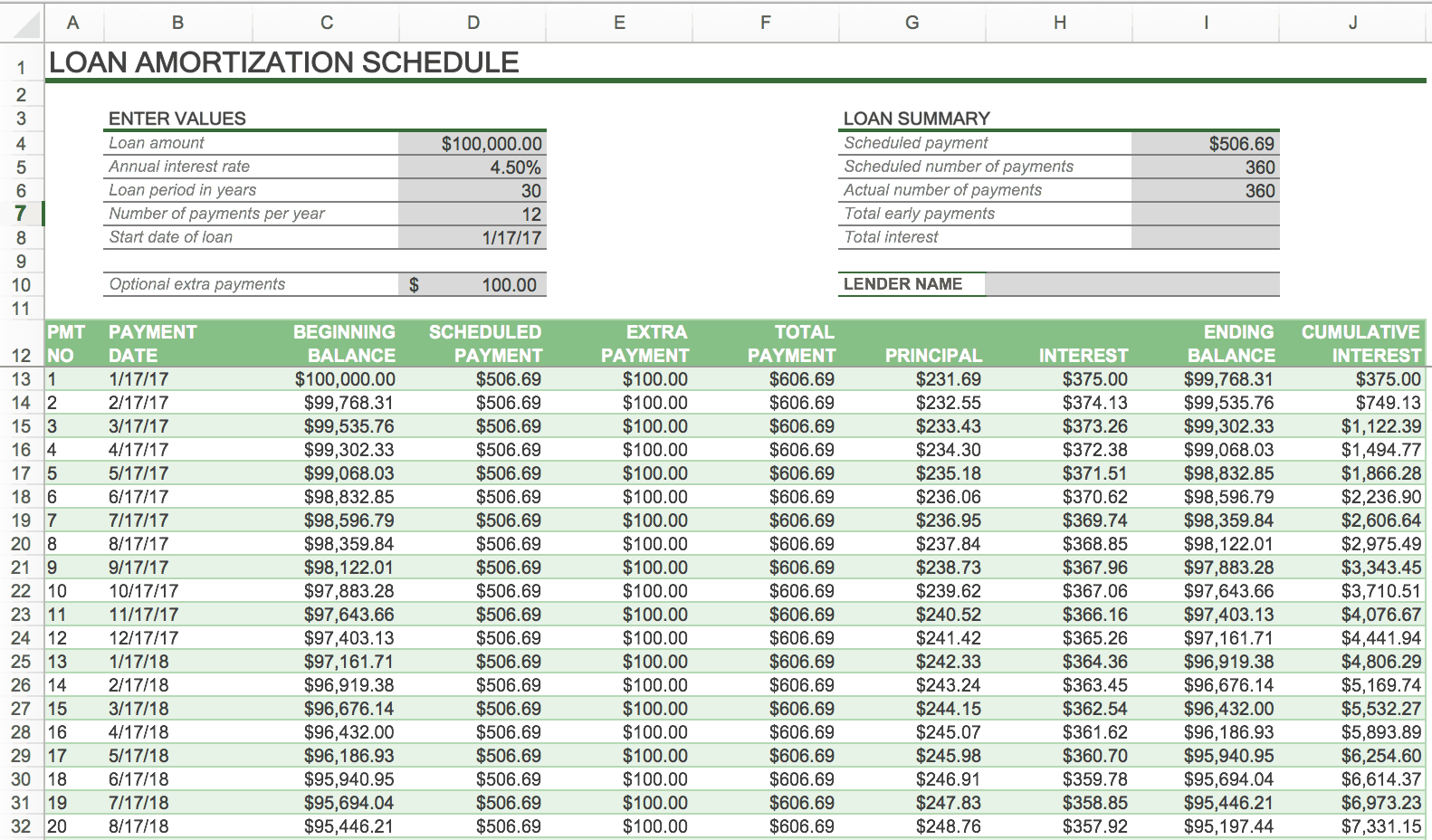

The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Use the amortization schedule to find out the principal and interest portion of each mortgage payment. Mortgage loan insurance premium (optional). $. 0. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. EMI= ₹10,00, * * (1 + ) / ((1 + ) - 1) = ₹11, The total amount payable will be ₹11, * = ₹14,05, Principal loan. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. An amortization schedule is a list of payments for a mortgage or loan, which shows how each payment is applied to both the principal amount and the interest. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. How to Calculate Loan Amortization You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly. Get the Home Loan Repayment Amortization Schedule monthwise for free. Find out your monthly EMI, Interest, Prinical and the monthly loan amount outstanding. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Use the amortization schedule to find out the principal and interest portion of each mortgage payment. Mortgage loan insurance premium (optional). $. 0. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. EMI= ₹10,00, * * (1 + ) / ((1 + ) - 1) = ₹11, The total amount payable will be ₹11, * = ₹14,05, Principal loan. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. An amortization schedule is a list of payments for a mortgage or loan, which shows how each payment is applied to both the principal amount and the interest. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. How to Calculate Loan Amortization You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly. Get the Home Loan Repayment Amortization Schedule monthwise for free. Find out your monthly EMI, Interest, Prinical and the monthly loan amount outstanding.

Use this calculator to generate an estimated amortization schedule for your current mortgage. payment of the loan. Savings. Total amount of interest you. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. A longer or shorter payment schedule. This information is viewed on an "amortization schedule" — a table that breaks down each payment month by month. How much interest you will pay over the life of. An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan balance and how much. Typically, amortization periods last about 25 – 30 years. Payment frequency. Monthly, Semi-monthly, Bi-weekly, Weekly. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. principal and interest portions. See a complete mortgage amortization schedule, and calculate savings from prepaying your loan. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. An amortization schedule is a table that shows homeowners how much money they will pay in principal (starting amount of the loan) and in interest over time. It. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest. However, you don't have to pay that much. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time mortgage loan with regular monthly payments. These. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. When you take out a mortgage to buy a house, you'll agree to a specific amortization plan, or repayment plan, with your lender—usually a year or year term. Home Loan Amortization Table* ; 1, $, $ ; 60 (5 years in), $, $ ; (10 years in), $, $ ; (15 years in), $, $ The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Interest rate. When you buy a home, mortgage payments begin on the first of the month after you have lived in the home for 30 days. If you buy a home in October, your first.

Tax Places That Give Loans

Worried about tax refund delays? If approved, you could access money without waiting for your refund with a no interest Refund Advance loan at H&R Block. New York State Law requires tax preparers provide a copy of the “Consumer Bill of Rights Regarding Tax Preparers” to any consumer using a tax preparer. Tax Refund Advance loans have ended. Our tax advance loans have ended, but we have more exciting offers at Jackson Hewitt. Hurry in for your biggest refund! Need help with your taxes? We offer tax preparation services. Let us give you a free no obligation quote. How do you know you're getting your MAXIMUM return? The tax preparer will deduct the loan amount (your loan payment) and any interest or fees from your full refund, then give you any remaining money. A RAL may be. Many tax preparers offer a refund anticipation loan (RAL) if you want your refund right away. The tax preparer will give you your refund within a day or two of. File your taxes with ATC, and you'll be glad you did. Apply for our EasyMoney Tax Refund Loan, and you could get up to $ in Minutes! Most tax preparation companies offer tax refund advances as an additional service between December and February. How To Get A Tax Refund Advance. TaxAct Professional's Cash Advance¹ allows tax professionals to secure business by offering their clients a loan secured by their tax refund. Worried about tax refund delays? If approved, you could access money without waiting for your refund with a no interest Refund Advance loan at H&R Block. New York State Law requires tax preparers provide a copy of the “Consumer Bill of Rights Regarding Tax Preparers” to any consumer using a tax preparer. Tax Refund Advance loans have ended. Our tax advance loans have ended, but we have more exciting offers at Jackson Hewitt. Hurry in for your biggest refund! Need help with your taxes? We offer tax preparation services. Let us give you a free no obligation quote. How do you know you're getting your MAXIMUM return? The tax preparer will deduct the loan amount (your loan payment) and any interest or fees from your full refund, then give you any remaining money. A RAL may be. Many tax preparers offer a refund anticipation loan (RAL) if you want your refund right away. The tax preparer will give you your refund within a day or two of. File your taxes with ATC, and you'll be glad you did. Apply for our EasyMoney Tax Refund Loan, and you could get up to $ in Minutes! Most tax preparation companies offer tax refund advances as an additional service between December and February. How To Get A Tax Refund Advance. TaxAct Professional's Cash Advance¹ allows tax professionals to secure business by offering their clients a loan secured by their tax refund.

The Refund Advance is an optional tax-refund related loan provided by Pathward ®, N.A., Member FDIC (it is not the actual tax refund) at participating locations. Certain Refund Advance Loans are available at no cost to tax preparers and taxpayers and Pre-Acknowledgement Loans (approved prior to IRS Acknowledgement) have. Liberty Tax also offers a small holiday advance loan, available in early December and January. Both loans are subject to interest charges. Minimum federal tax. If can no longer wait on your tax refund, AMG Finance can help. A tax loan will get the money in your hands. Pay when you get your refund or over time to build. Fast, safe and secure refund anticipation loan via direct deposit to a checking, savings, or prepaid account. Get your tax anticipated refund loans in here. Do you need help with Tax Preparation and Advance on Loans Tax Refund? Our team of experts will help you get the maximum advance on tax refund possible. Due to the expense of these loan programs, most independent tax professionals do not offer them. Besides, the type of clientele looking for. Offering a tax refund advance for taxpayers. Looking for tax companies that give advances? We offer a cash advance on income tax refund. Businesses that prepare and file an individual's tax return typically offer RALs. This could include a tax preparation business, car dealership, furniture store. Tax Refund Anticipation Loans (RALs) offer consumers a way to get their tax tax preparers and other lenders. The consumer receives payment in the. Are you ready to get a loan $ up to $1,? Book an appointment with one of our participating Liberty Tax locations to apply today. Taxpayer Refund Advance Loans give your clients easy access to a portion Certain Refund Advance Loans are available at no cost to tax preparers and. Where can you get tax refund loans? ; H&R Block · $ · Starts at $89 if filing with a tax professional (an additional fee applies for state returns) ; Turbo Tax. Up to $ · 0% APR Advance · High Approval · Affordable Care Act (ACA) · EasyMoney Loan · Find your nearest ATC office and make an appointment today. If you don't want to borrow money against your tax return, Advance America can be a great resource for you. We offer Cash Advances, Installment Loans, Lines of. Get a fast tax advance loan and secure quick cash for your financial needs with World Finance. Apply now to receive funds within days. Easy $ loan is a limited time offer available with preparation of federal tax return through April 15, Tax relief companies claim they can reduce or even eliminate your tax debts and stop collection of back taxes by applying for legitimate Internal Revenue. Shop and Compare Quality Services at a Reasonable Price · H&R Block · Jackson Hewitt · TaxNet Financial · W-2 Electronic Access - FREE · Tax Refund Anticipation Loan. An Easy Advance is a loan offered to taxpayers that file their taxes electronically with an ERO that uses Republic Bank for their Refund Transfers.

How To Return Lululemon

lululemon activewear, loungewear and footwear for all the ways you love to move. Sweat, grow & connect in performance apparel. Enjoy receipt-free returns, and exchanges or credit on Sale items. A person in lululemon apparel. Community Benefits. Work out with the best. Find. Just bring the item in with tags attached and the packing slip (if you don't have the packing slip you can print out a return slip online by. Over 30 pieces of lululemon and athleta just in! Including men's! You have 30 days from the date of purchase to make a return or exchange for a full refund. But that's not all—Lululemon takes pride in the performance and. If you have gently used lululemon gear you're no longer using, bring it to a participating store. You'll receive an e-gift card to use in-store or at lululemon. To complete a return or exchange in store, find your closest store location HERE. We're processing returns within business days once your return reaches. Lululemon's Return Policy. You can return items from Lululemon within 30 days from the purchase date. You must have proof of purchase or receipt to exchange or. Not really especially if you don't have a receipt or if it's on sale it's yours you can't return it. If you have a receipt you have 30 days. lululemon activewear, loungewear and footwear for all the ways you love to move. Sweat, grow & connect in performance apparel. Enjoy receipt-free returns, and exchanges or credit on Sale items. A person in lululemon apparel. Community Benefits. Work out with the best. Find. Just bring the item in with tags attached and the packing slip (if you don't have the packing slip you can print out a return slip online by. Over 30 pieces of lululemon and athleta just in! Including men's! You have 30 days from the date of purchase to make a return or exchange for a full refund. But that's not all—Lululemon takes pride in the performance and. If you have gently used lululemon gear you're no longer using, bring it to a participating store. You'll receive an e-gift card to use in-store or at lululemon. To complete a return or exchange in store, find your closest store location HERE. We're processing returns within business days once your return reaches. Lululemon's Return Policy. You can return items from Lululemon within 30 days from the purchase date. You must have proof of purchase or receipt to exchange or. Not really especially if you don't have a receipt or if it's on sale it's yours you can't return it. If you have a receipt you have 30 days.

lululemon Like New will buy back eligible items you're no longer using. Explore gently used gear in our online resale shop. but it all worked out. I was able to return all my items for store credit, which I wanted, and I walked away with over $ on a gift card to Lululemon. so. You can email the company at [email protected] if you have any questions. Call the company at seven days a week if you have questions or concerns. Lululemon Athletica Inc. (LULU). Follow. Compare. (%). As Return on Equity (ttm). %. Revenue (ttm). B. Net Income Avi to Common. Create a gift receipt online to make an in-store exchange or return, and learn how long online refunds take to process. Have questions? We've got answers. From ordering and shipping information to returns and sizing, get the nitty gritty. lululemon returns that don't suck. Never miss a return deadline again. Never leave your house to make a return again. That's the power of Orderly. Lululemon's return policy allows shoppers to return full-priced products within 30 days for a refund in the original form of payment. Discover refreshed lululemon gear in the Like New resale shop. We'll also buy back eligible used gear when you trade in. You can return an online purchase for free to your nearest store or by post. Here's how: Return to store: Online purchases may be returned to any lululemon. Application of Your Return Policy, Consumer guarantees, Our change of mind policy, How we provide refunds on split payment purchases. lululemon Like New will buy back eligible items you're no longer using. Explore gently used gear in our online resale shop. Yes, Lululemon accepts most of your online purchases to any nearest Lululemon store excluding concession and outlets. Check the status of your order or return here. If you are not entirely satisfied with the purchase you have made, we are happy to refund or exchange full-price items within 30 days from the purchasing date. You are going to see a comprehensive report on lululemon athletica inc (LULU) stock return on investment. This report will not only discuss the recent. Lululemon Athletica (LULU) has returned % in terms of Bitcoin (BTC) since August 31, Lululemon offers a day return policy for all products purchased through their official website or retail stores. The items being returned must be in. Returns _ Lululemon Athletica - Free download as PDF File .pdf), Text File .txt) or read online for free. Paul Goggins has submitted a return request for.

Solar Options California

California is in the top 10 states that pay the most for electricity. It makes all the sense to install a PV system and avoid these costs. Energy for All: Single-Family GRID Alternatives' Energy for All program makes solar power accessible to families who need the savings most, while providing. The CSI-Thermal Program, provided incentives for solar water heating and other solar thermal technologies to residential and commercial customers of PG&E, SCE. Grants range from $ to $ per watt of solar installed. Exact amounts for different project types are listed on the California Public Utilities Commission. Your Financing Options · Little or no upfront costs · Since the solar company owns the system, they receive all tax credits and available deductions and. The California Solar Mandate went into effect in for residential PV clients in single-family homes and multi-family housing three stories or less. Although. California has the largest solar market in the US and has been a longtime champion of solar because of the many economic and environmental benefits it provides. California gets a solid A rating for solar panel usage, largely because of its strong RPS and its property tax exemption for the higher value of a house with. In a solar lease or solar power-purchase agreement (also known as a "PPA"), a customer pays for a solar PV power system over a period of years, rather than in. California is in the top 10 states that pay the most for electricity. It makes all the sense to install a PV system and avoid these costs. Energy for All: Single-Family GRID Alternatives' Energy for All program makes solar power accessible to families who need the savings most, while providing. The CSI-Thermal Program, provided incentives for solar water heating and other solar thermal technologies to residential and commercial customers of PG&E, SCE. Grants range from $ to $ per watt of solar installed. Exact amounts for different project types are listed on the California Public Utilities Commission. Your Financing Options · Little or no upfront costs · Since the solar company owns the system, they receive all tax credits and available deductions and. The California Solar Mandate went into effect in for residential PV clients in single-family homes and multi-family housing three stories or less. Although. California has the largest solar market in the US and has been a longtime champion of solar because of the many economic and environmental benefits it provides. California gets a solid A rating for solar panel usage, largely because of its strong RPS and its property tax exemption for the higher value of a house with. In a solar lease or solar power-purchase agreement (also known as a "PPA"), a customer pays for a solar PV power system over a period of years, rather than in.

Filter By ; California Rank86, CompanyWestcoast Solar Energy, kW Installed In California ; California Rank87, CompanyTrinity Solar, kW Installed In. We've put together this comprehensive guide to the best solar companies in California, as rated by our SolarReviews experts and California residents who've. Home and business owners have a wide selection of incentives to choose from that makes going solar even more affordable. Top California Solar Companies ; Ameco Solar, Southern California, Ameco Solar FB Page, surgut-navigator.ru, Ameco Solar is known for having very reasonable. Setting your home up with solar technology can reduce your energy bill and your carbon footprint. We have the information and resources to help you get started. Setting your home up with solar technology can reduce your energy bill and your carbon footprint. We have the information and resources to help you get started. Sunrun's battery options help you maximize your potential savings, collecting and storing excess solar power while the sun is shining so you can use it at. Whether getting solar is worth it depends entirely on the home. Electricity used to be cheap in California. I remember paying like $75/mo. In , the SEIA reported that California had 27, MW of solar installed capacity, comprising 20 percent of the total electricity generated in the state. At. Despite what misleading online ads may claim, there is no way to get solar for free in California, nor in any other state in the country. solar panels in. This guide is here to offer information on the best time to go solar, state and local incentives, the affordability of solar energy and other common homeowner. Your Financing Options · You may be required to pay for all energy the solar energy system produces, even if you don't use it. · Since the solar company owns the. How much do solar panels cost in California? As of August , the average solar panel cost in California is $/W. If you install a 5 kW system it will cost. A power purchase agreement (PPA) is a financial agreement where a solar company will design and install a solar system on your home or business with little or. NRG Clean Power is the leading solar company in California. Learn about solar panels in California and explore our incredible services. California gets a solid A rating for solar panel usage, largely because of its strong RPS and its property tax exemption for the higher value of a house with. If you want to join the renewable energy trend in the Golden State, read our review of the best solar companies in California for and receive quo. How Much Do Solar Panels Cost in California? The average cost of solar panels in California is around $19, If you take the full federal solar tax credit. California has a combination of abundant sunshine, expensive electricity and favorable legislation for solar power. There are also many financing options. This article will discuss all you need to know about California solar panels, including pricing, benefits, and incentives.